Saving money safely while earning steady returns is a priority for many investors in India. One of the most trusted options for this purpose is the Post Office Fixed Deposit scheme. Backed by the Government of India, this scheme is known for its stability and guaranteed returns. Understanding the post office fd interest rate in 2025 is essential for anyone planning a low-risk investment.

This guide explains interest rates, eligibility, features, calculation methods, tax rules, and both online and offline account opening processes in a clear, step-by-step manner.

What Is the Post Office FD Interest Rate?

The post office fd interest rate refers to the annual interest offered by the Department of Posts on fixed deposit accounts opened for a specific tenure. These rates are reviewed periodically by the government and are generally aligned with small savings schemes.

Unlike market-linked investments, the interest rate here remains fixed for the chosen tenure, offering predictable returns and peace of mind to investors.

Process of Opening a Post Office FD Account Online and Offline

Opening a Post Office Fixed Deposit is straightforward. You can choose either the online or offline route.

Visit the official India Post website online:

- Log in using your Post Office savings account credentials

- Select “Fixed Deposit” from available schemes

- Enter deposit amount and tenure

- Submit the request and confirm payment

Once completed, your FD details will be visible in your account dashboard.

Steps to open Post Office FD Offline:

- Visit the nearest Post Office branch

- Collect the Fixed Deposit application form

- Fill in personal and deposit details

- Submit documents and deposit amount

- Receive acknowledgment receipt

This offline method is preferred by individuals who are not comfortable with digital banking.

Documents Needed for Opening a Post Office Fixed Deposit

To open a Post Office FD account, applicants must provide basic KYC documents.

- Aadhaar Card (mandatory for KYC)

- PAN Card

- Address proof (Voter ID, Driving License, or utility bill)

- Passport-size photographs

- Account opening form

Ensuring accurate documentation helps avoid delays in account activation and future services.

Key Features of Post Office FD

The Post Office Fixed Deposit scheme offers several investor-friendly features.

| Feature | Details |

| Government-backed | Yes |

| Minimum deposit | ₹1,000 |

| Maximum limit | No limit |

| Tenure options | 1, 2, 3, and 5 years |

| Interest payout | Compounded quarterly |

| Premature withdrawal | Allowed with conditions |

| Nomination facility | Available |

Because of these features, the post office fd interest rate scheme is often chosen by retirees and risk-averse investors.

Eligibility to Open a Post Office FD Account

Before investing, it is important to understand who can open an account.

- Any Indian resident above 18 years

- Joint account holders (up to three adults)

- Guardians on behalf of minors

- Senior citizens (special consideration on safety, not rate)

While there is no separate scheme for seniors, many still compare the post office fd interest rate senior citizen option with bank FDs for safety reasons.

Post Office FD Interest Rates 2025

Here is a more detailed view of how interest accumulates.

| Deposit Amount | Tenure | Interest Rate | Maturity Amount (Approx.) |

| ₹50,000 | 1 Year | 6.9% | ₹53,540 |

| ₹1,00,000 | 3 Year | 7.1% | ₹1,23,000 |

| ₹2,00,000 | 5 Year | 7.5% | ₹2,89,000 |

As per the latest updates, Post Office Fixed Deposit interest rates for 2025 are structured based on deposit tenure.These rates make the post office fd interest rate competitive compared to many bank FDs, especially for long-term conservative investors.

Types of Post Office FD Schemes

Post Office Fixed Deposits are categorized based on tenure.

Available FD Schemes

- 1-Year Fixed Deposit

- 2-Year Fixed Deposit

- 3-Year Fixed Deposit

- 5-Year Fixed Deposit (eligible for tax benefits under Section 80C)

Each scheme offers a different post office fd interest rate, allowing investors to plan based on financial goals.

Benefits of Using Post Office Fixed Deposit Calculator

A fixed deposit calculator helps estimate returns before investing.

Why Use a Calculator?

- Predict maturity amount

- Compare tenure-wise returns

- Plan long-term savings

- Avoid manual calculation errors

Some investors also compare this with tools like the Post Office FD calculator monthly interest to understand compounding benefits.

Post Office FD Investment Rules

Before investing, it is essential to understand the rules governing Post Office FDs.

Important Investment Rules:

- Minimum deposit amount is ₹1,000

- Deposits must be in multiples of ₹100

- Premature withdrawal allowed after 6 months

- Interest penalty applicable for early withdrawal

- Auto-renewal not available by default

Understanding these rules ensures you make informed investment decisions.

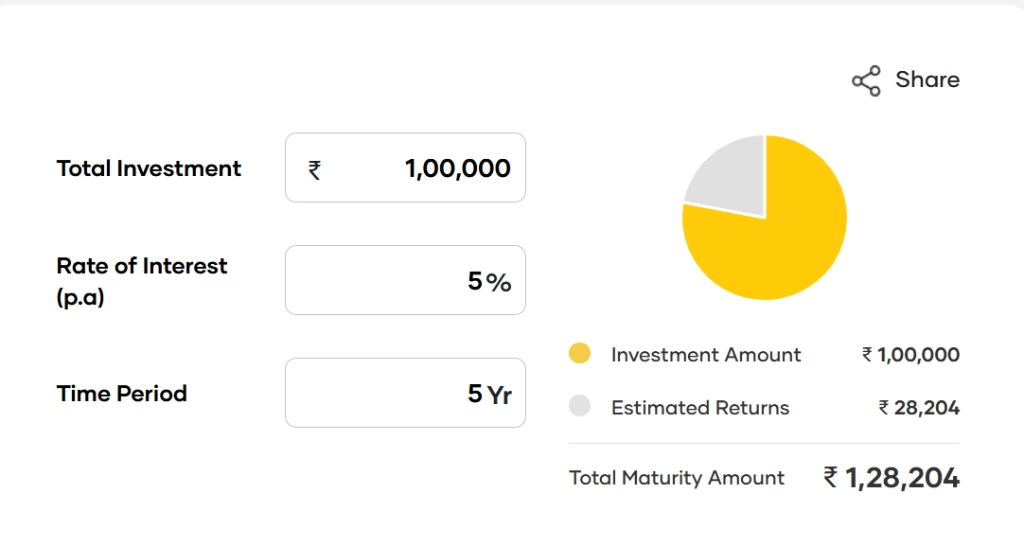

Post Office FD Calculator

The Post Office FD Calculator is an online tool that automatically computes interest based on deposit amount, tenure, and applicable rate.

It is especially useful for investors comparing Post Office schemes with other options such as the post office monthly income scheme or bank FDs.

TO READ MORE SUCH iNTERESTING “ACTIVE MONEY” GOVERNMENT RUNNING SCHEME:

How to Calculate Interest on Post Office FD?

The interest on Post Office FD is compounded quarterly but paid annually.

Interest Calculation Formula

M = P × (1 + r/n)^(nt)

Where:

- M = Maturity amount

- P = Principal amount

- r = Annual interest rate

- n = Compounding frequency

- t = Tenure in years

Using this formula manually can be complex, which is why calculators are recommended.

Tax Rules on Post Office FD Scheme

Taxation is an important factor to consider while investing.

Tax Rules:

- Interest earned is fully taxable

- TDS is applicable as per income tax rules

- 5-year FD qualifies for Section 80C deduction

- No tax exemption on interest income

Even though the post office fd interest rate is attractive, investors should factor in tax liability while planning.

Additional Points to Know

- Nomination facility ensures smooth transfer in case of death

- Accounts can be transferred between post offices

- Tracking of FD account status can be done via official services similar to post office tracking

These features add flexibility and convenience for long-term investors.

Frequently Asked Questions:

Can I add more money to an existing Post Office FD account?

No, additional deposits are not allowed in an existing Post Office FD. To invest more, you must open a new fixed deposit account.

Is nomination mandatory while opening a Post Office FD?

Nomination is not mandatory, but it is highly recommended. It helps ensure smooth transfer of funds to the nominee in case of the account holder’s death.

What happens to my Post Office FD after maturity if I do nothing?

If no action is taken after maturity, the FD does not auto-renew. The amount remains in the post office account and earns savings account interest until withdrawn.